Share post now

Article

Mercosur: fragmented impact assessments

09.12.2020, Trade and investments

After the conclusion of negotiations on the free trade agreement with Mercosur countries, the State Secretariat for the Economy commissioned an impact assessment regarding selected environmental issues. Social affairs and human rights were left out.

Use of pesticides for large-scale cultivation of GM soy in Uruguay. The feed is exported to China and the EU.

© Joerg Boethling

Article

Tanzania plans to work the largest nickel deposit

19.03.2021, Trade and investments

The Tanzanian Government has signed an agreement on nickel mining with a British corporation under which profits will be split equally. State interventions can also be observed in neighbouring Zambia.

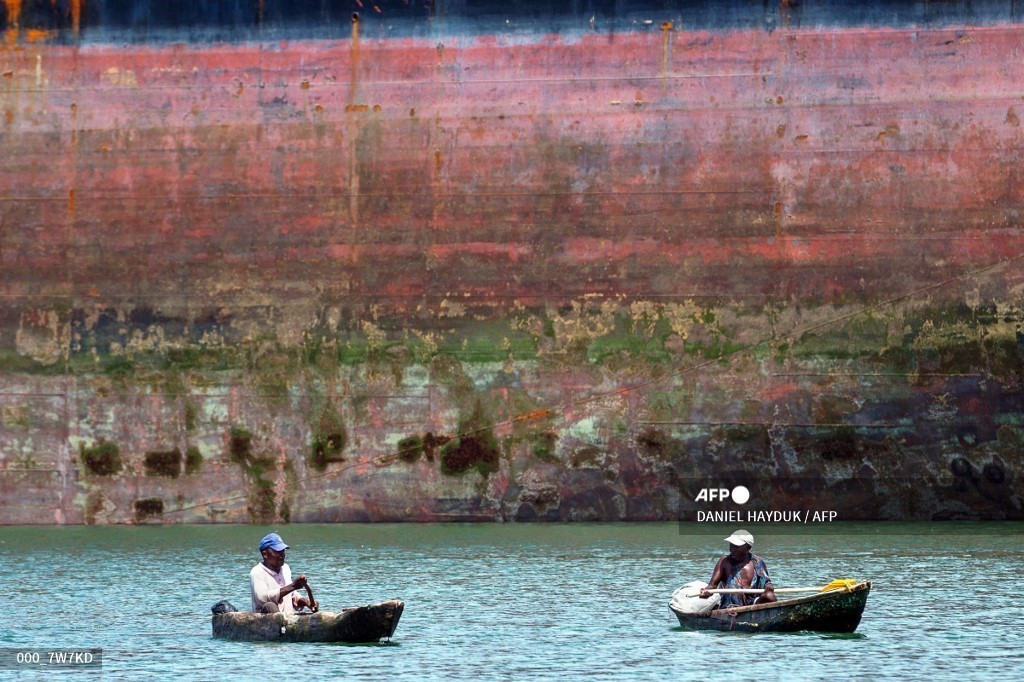

Two fishermen row in front of the Marshall Islands-flagged oil tanker "Miracle" after it ran aground in the mouth of Dar Es Salaam harbor on February 13, 2016.

© Daniel Hayduk / AFP

Share post now

Article

New law is needed to link economy and human rights

21.06.2021, Trade and investments

Even with growing numbers of human rights abuses as evidenced by the cases of China and Myanmar, Switzerland lacks any legal basis for the rapid introduction of targeted economic measures.

© Johannes Eisele / AFP

Share post now

Medienmitteilung

MC12 : Exclusive rights must finally be lifted

25.11.2021, Trade and investments

The WTO Ministerial Conference, to be held in Geneva from 30 November to 3 December, will discuss the temporary waiver of intellectual property protection on vaccines, tests and anti-covid drugs. We urge the Swiss government to stop its systematic blocking at the WTO, which has been going on for over a year. For their part, we also urge pharmaceutical companies to share their know-how without restriction.

© Tim Reckmann / pixelio.de

Share post now

Article

WTO: Switzerland can breathe easily – for now

29.11.2021, Trade and investments

Despite the postponement of the WTO Ministerial Conference, Switzerland is finding itself increasingly isolated in its opposition to the waiver of patent protection on Covid vaccines. The WTO General Council could and should decide quickly.

WTO Headquarter in Geneva

© Isolda Agazzi

Share post now

Article

Trade and climate: real efforts or greenwashing?

29.09.2023, Trade and investments

The election of Luiz Inácio Lula da Silva as President of Brazil has revived the subject of the EFTA free trade agreement with Mercosur – but the climate-related promises could prove to be greenwashing.

A logger not far from indigenous land in the Amazon forest in the state of Rondonia, Brazil.

© Lynsey Addario/Getty Images

Share post now

Article

Glencore sues Colombia over Cerrejón Mine

22.03.2022, Trade and investments

No sooner had the announcement on giving up fossil fuels been made, than Switzerland's Glencore International became the sole owner of Latin America's biggest open pit coal mine. It is even taking the Colombian State to court.

The Arroyo Bruno, a tributary of a major river in La Guajira, was diverted to intensify coal extraction at the La Puente quarry.

© Colectivo de Abogados José Alvear Restrepo (CAJAR)

On 11 January, Glencore – the world's biggest exporter of thermal coal – announced that it had acquired the stakes held by BHP and Anglo-American in "Carbones del Cerrejón", Latin America's biggest open-pit coal mine and one of the world's largest. The commodity trading multinational from Switzerland had struck a good bargain: thanks to higher demand and the corresponding high price of coal, Glencore was able to become the sole owner of "Carbones del Cerrejón" for just USD 101 million. The two other companies sold their stakes under pressure from their shareholders to give up the fossil fuels most harmful to the environment, for the sake of combating climate change. Glencore itself has no scruples in this regard, even though the company has committed to reducing its overall carbon footprint by 15 per cent by 2026, 50 per cent by 2035, and to becoming a zero-emissions concern by 2050.

A mine responsible for gross human rights abuses

"The Cerrejón coal mine has been operating for so many years now – mining began in 1985 – that the abuse of power and the asymmetry evident among the owners, the communities and the State have been amply documented. Severe human rights violations have been committed in particular against Afro-indigenous communities, mainly the Wayúu", says Rosa María Mateus of CAJAR, a Colombian lawyers' collective that has been championing human rights for the past 40 years.

"Carbones del Cerrejón has already been sanctioned in more than seven court cases", she continues. The penalties were never enforced, however, as the company benefits from the extreme poverty in these communities. La Guajira, where the mine is located, is Colombia's second most corrupt department. Children are dying of hunger and thirst, while the company takes advantage of the situation to offer compensation payments which the communities regard as a mockery. To address the climate crisis, which is hitting La Guajira's residents the hardest, we must change the economic model and get out of coal."

Constitutional Court declares Arroyo Bruno diversion unacceptable

One of the aforementioned rulings concerns the Arroyo Bruno, a tributary of a major river in La Guajira and which was diverted to facilitate expanded mining operations at the La Puente quarry. This river is flanked by tropical dry forest, a highly threatened ecosystem. In 2017, the Colombian Constitutional Court held that the approval process for expanded coal mining had failed to consider substantial social and environmental impacts on the rights of local communities. One crucial consideration was that the region is plagued by acute water shortages and is especially vulnerable to climate change.

The Court ordered that work should be stopped and a new environmental impact assessment conducted so as to gauge the compatibility of expanded open-pit mining with the protection of the communities' rights. In retaliation, Glencore filed a suit against Colombia with the ICSID, the World Bank's arbitration body, invoking non-compliance of the investment protection agreement between Colombia and Switzerland. In its complaint, the multinational asserted that the decision by the Colombian court regarding the course of the Arroyo Bruno, which was hampering the expansion of the mine, was "unreasonable, incoherent and discriminatory". To date, one arbitrator has been appointed and no further information has transpired, not even about the compensation being sought by Glencore.

"It is outrageous that they are seeking compensation for the damage they themselves have caused", says an angry Rosa María Mateus. "The company claims to be following an environment-friendly policy and planting trees; as we have discovered, that is all a lie. It is not abiding by environmental standards and is not managing to repair even the barest minimum of the damage caused. We were able to verify the existence of water and air pollution and the negative impacts on the health of citizens. These are very serious breaches, especially in the light of discussions in Europe about decarbonisation and leaving coal in the ground".

Possible use of an amicus curiae brief

So what can CAJAR do? Rosa María Mateus admits that they have limited room for action. The only option is known as an amicus curiae brief, which is a written submission through which the voice of communities can be heard; but it must be approved by the court. According to Mateus, the court nevertheless offers no guarantees for victims, as it is a kind of private justice system that was created to protect big companies.

"We will be attempting it all the same, and have just started compiling the arguments of the communities. Next, we plan to forward the amicus curiae brief to friendly organisations like Alliance Sud, so that they can help us publicise the situation. Companies command considerable media clout, and it is their own truths that get published, not the tragedies of victims. Glencore has been extracting raw materials on a large scale in Colombia, despite the very weak state of the country's economy. The company poses a threat to the sovereignty of the State and above all to the courts, whose jurisdiction it is calling into question – a practice that harks back to colonial times."

Glencore's third lawsuit against Colombia

According to the United Nations Conference on Trade and Development (UNCTAD), Colombia is facing a flood of 17 lawsuits, a number that does not even include the latest one by Glencore. For the first time in 2016, the corporation had challenged a contract relating to the Prodeco coal mine and obtained USD 19 million in compensation payments. Such cases are adjudicated by a court comprising three arbitrators, of whom one is nominated by the foreign multinational corporation, one by the accused country and the third by both parties. The courts may admit amicus curiae briefs – for the most part written submissions generally laying out the viewpoints of the affected communities, and submitted by NGOs. So far, 85 amicus curiae applications have been filed, of which 56 have been admitted. The investment protection agreement on which the Glencore lawsuit is based does not provide for the possibility of an amicus curiae brief. The agreement is now being renegotiated and Alliance Sud is calling for the new agreement to provide for possibility of an amicus curiae brief, even though this is of no relevance to the pending proceedings.

Rosa María Mateus will be in Switzerland at the end of April / beginning of May to report on this case.

© Rosa María Mateus

"The children starve and die of thirst; the company takes advantage of the situation and offers compensation payments that are a mockery in the eyes of the communities."

Share post now

Press release

Switzerland blocks the COVID-19 waiver

10.06.2022, Trade and investments

The WTO is heading for a major political failure in its response to the coronavirus pandemic. As its 12th Ministerial Conference opens the day after tomorrow in Geneva, member states are unable to agree on India and South Africa's request to suspend intellectual property rights on vaccines, tests and anti-covid drugs. Through its systematic blocking, Switzerland is at the forefront of this multilateral failure, which offers no coherent solution for equitable access to means of fighting health crises.

© Patrick Gilliéron Lopreno

Next week, the credibility of the WTO and its Director General Ngozi Okonjo-Iweala will be at stake in Geneva. Among the topics on the agenda of the 12th Ministerial Conference (MC12), which will be held from June 12 to 15, is the TRIPS waiver, named after the request for temporary suspension of intellectual property rights for the production and marketing of vaccines, tests and anti-covid drugs filed by India and South Africa in October 2020. This request was supported by a hundred countries as well as numerous international organizations and personalities, but the States hosting the large pharmaceutical companies, such as Switzerland, systematically blocked it.

If the MC12 Conference finally reaches an agreement, we will be very far from a generalized suspension of intellectual property rights, in view of the latest texts made public. The decision will at most be a reminder of existing instruments, such as compulsory licensing, which allows a State to authorize the marketing of generics despite the existence of a patent. However, other exclusive rights, such as trade secrets or the protection of registration data, are proven barriers to equitable access and technology transfer, which a compulsory license will not be able to overcome. Moreover, it will be necessary to proceed product by product, country by country, not to mention the diplomatic and commercial pressures that systematically accompany this type of approach. The only concession that could be considered a waiver is the possibility for an eligible country to re-export a vaccine produced under a compulsory license, but in a very limited way.

This text, presented as a "compromise" between the Members, is in fact imposed by the Western countries, including Switzerland. Unless there is a U-turn at MC12, it will not resolve the inequitable distribution of resources in the fight against Covid-19. First, it only covers vaccines, while access to treatments and diagnostic tests is equally inequitable due to the exclusive rights held by Pfizer, Roche and others. Secondly, it excludes many countries from the possibility of using it for commercial or geopolitical reasons, whereas WTO rules are supposed to apply everywhere, without discrimination. Finally, it creates new obstacles for eligible countries to use this mechanism, setting a dangerous precedent that will also hamper the response to future pandemics.

Such an agreement is unworthy of Western countries like Switzerland that claim to respect human rights, including the right to health. As the host country of the MC12, and as the chair of the WTO's highest decision-making body since last March, Switzerland had the necessary leverage to positively influence the final outcome. Even though it is (over)supplied with vaccines, treatments and tests, it preferred to favour the interests of the pharmaceutical companies, which will thus be able to continue to decide who receives how much, when and at what price. Covid-19 showed that the WTO did not have adequate rules to respond effectively to a global health crisis, and it did nothing to put them in place for eighteen long months.

Informations:

Isolda Agazzi, Alliance Sud, Trade policy expert, isolda.agazzi@alliancesud.ch, +41 21 612 00 97

Patrick Durisch, Health policy expert, Public Eye, patrick.durisch@publiceye.ch, +41 21 620 03 06

Share post now

Article

Switzerland must withdraw from the Energy Charter

05.12.2022, Trade and investments

The Energy Charter Treaty protects companies that invest in fossil fuels. A growing number of countries are withdrawing from it, while Switzerland continues to thwart the energy transition.

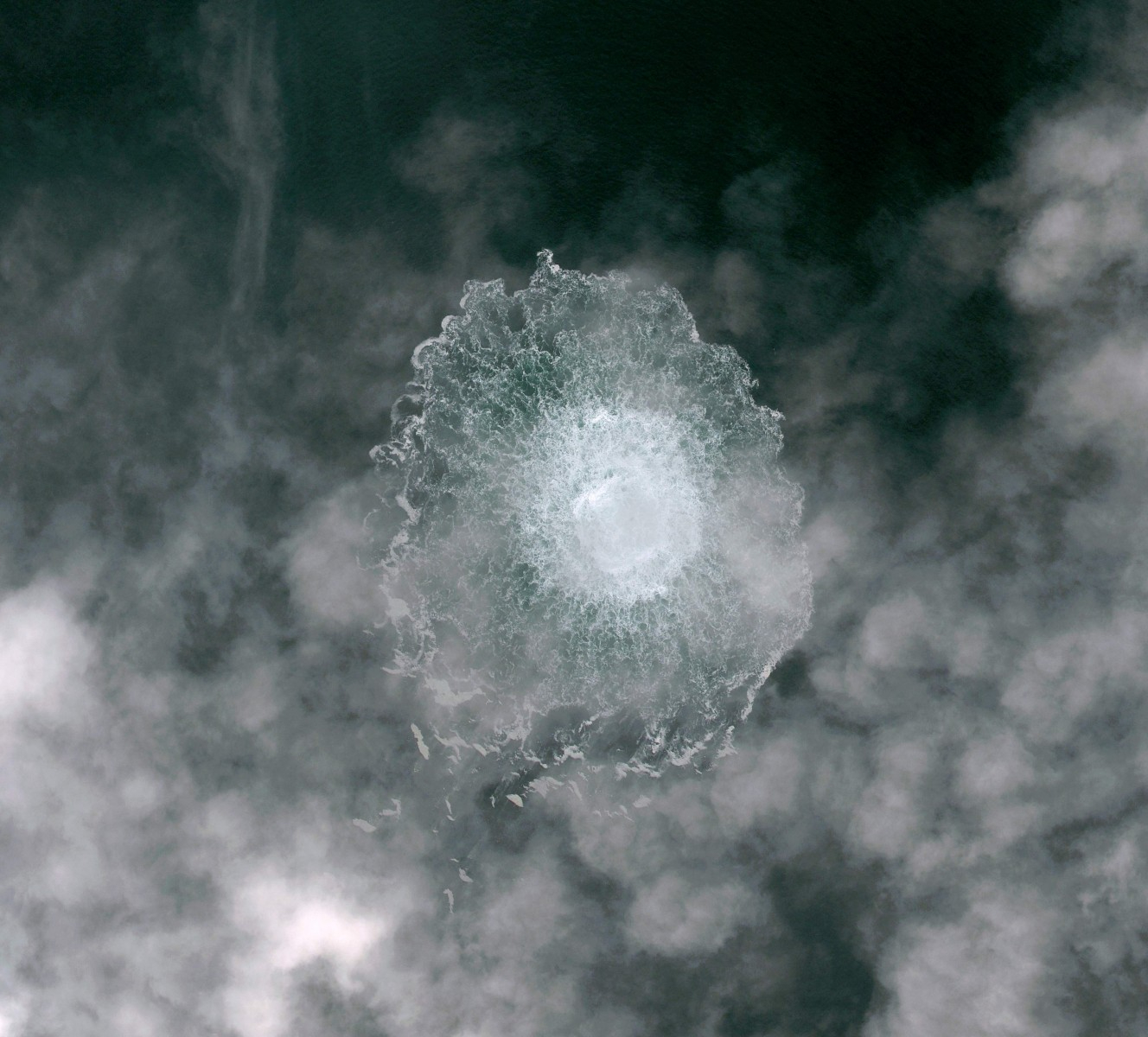

The Nord Stream gas pipeline leak in the Baltic Sea, photographed by the Pleiades Neo satellites.

© AFP Photo / Airbus DS 2022 / Keystone

The Energy Charter Treaty (ECT) has been in force since 1998 and forms the basis on which companies can sue a State if they believe that their investments have made a loss owing to some government intervention. Most of the 53 signatory States are industrialized countries like Switzerland and the EU Member States, but countries like Afghanistan, Yemen, Mongolia and some in Central Asia are also on board.

In 2019, for example, Nord Stream 2 AG filed a suit against the EU decision relating to an EU Gas Directive amendment under which intra-EU pipelines would be subject to the same rules that govern those coming from outside the EU. According to the company, these provisions conflicted, among other things, with the principles of fair and equitable treatment, most-favoured nation treatment and indirect appropriation, all of which are envisaged in the Energy Charter Treaty (ECT).

Let us recall that Nord Stream 2 was meant to transport natural gas from Russia to Germany, but the operating company – a Swiss company – went bankrupt early this year. It did in fact belong to the Russian state-owned company Gazprom, but was headquartered in Zug. The controversial pipeline never began operations, as Germany blocked the project on 22 February 2022 following Russia’s invasion of Ukraine.

Six complaints by Swiss investors

Of the 43 known requests for arbitration filed by Swiss investors, six are based on the Energy Charter Treaty: three were brought against Spain. Of these, two are still pending, while the decision went in favour of the investor OperaFund in the other. OperaFund had accused Madrid of introducing reforms affecting the renewables sector, including a 7 per cent tax on power generators’ revenues and a reduction in subsidies for renewable energy producers. Alpiq lost a case against Romania, while another against Poland was decided against Swiss investor Festorino.

According to Transnational Institute calculations compensation claims by foreign investors are at least EUR 7 million. It is no surprise therefore that Germany, Spain, France, Poland and the Netherlands have decided to denounce the Treaty. Oher European countries are currently pondering withdrawal. "I am observing with concern the return of hydrocarbons and the fossil fuels most damaging to the environment," French President Emmanuel Macron is quoted as saying in the "Le Monde" newspaper "The war on European soil should not make us forget our climate obligations and our commitment to reducing CO2 emissions. Withdrawing from this treaty is part of the strategy."

According to the latest figures published by the Energy Charter Secretariat, 142 complaints have been filed on the basis of this Treaty; the number could be far greater, however, as States are not required to notify them. The Treaty therefore breaks all records in terms of complaints filed. Germany, for example, has been sued twice over its decision to give up atomic power: in the case "Vattenfall v. Germany (I)", the amount of the compensation paid by Berlin to the Swedish company is not known; in the case of " Vattenfall v. Germany (II)", the Swedish company received USD 1.721 billion in compensation.

Switzerland unwilling to withdraw

Switzerland, for its part, has so far never been sued on the basis of the ECT. Only a single investment arbitration case has been brought against the country – by an investor from the Seychelles – albeit not based on the ECT. It is still pending. Is Switzerland considering denouncing the treaty? "No", replies John Christophe Füeg, Head of International Energy Affairs in the Swiss Federal Office of Energy, and adds: "The Treaty's critics are overlooking the fact that it applies only to foreign investments. In other words, domestic investments or those from non-signatory states are not covered by it."

In his view, the latest version of this Charter, adopted by Switzerland, should drastically reduce the number of cases and limit the scope of the Treaty. “The EU will now count as a single party, which means that complaints by investors within the EU are now out of the question”, he adds. Consequently, the ECT becomes a treaty with effect in the EU, the United Kingdom, Japan, Turkey, Ukraine, Azerbaijan and Switzerland; the remaining parties have virtually no investors. But the fact is that more than 95 per cent of fossil fuel investments in the EU are either internal EU investments, or made by non-contracting parties. This, for example, enables some EU Member States to merrily continue promoting hydrocarbons (e.g., Cyprus, Romania, Greece and the Netherlands). “The argument to the effect that withdrawal is crucial to climate protection is not acceptable, as less than 5 per cent of investments in fossil fuels is impacted. The remaining 95 per cent is beyond the scope of the Treaty."

According to Füeg, a survey was also conducted amongst Swiss investors with assets in the EU. The respondents indicated that they value the legal protection they enjoy under the ECT. "Switzerland would harm its own interests by withdrawing", he concludes.

Adapting the Treaty is not enough

But even the modernised version of the Charter, which is insufficient to combat climate change, is not about to enter into force. Although it was due to be approved by the States Parties at a meeting on 22 November in Ulan Bator, Mongolia, the modernisation was taken off the agenda after EU Member States failed to agree.

For Alliance Sud, Switzerland should join the other European countries that have already taken the step and leave this treaty, which allows a foreign investor to sue a host state for any regulatory change – closure of a coal-fired power plant, exit from nuclear power, change of regulation in renewable energies, etc. – and thus hinders the energy transition and the fight against climate change. It is not acceptable for foreign investors in fossil fuels to be above national laws and to have recourse to a private justice system that too often awards them millions or even billions in damages.

Share post now

Article

Making (even more) money from the corona crisis

05.10.2020, Trade and investments

In Latin America, multinational enterprises are suing States over measures they have taken to combat the covid 19 pandemic. Investment protection treaties that allow this should be abolished!

Lunch break at the company K. P. Textil in San Miguel Petapa in Guatemala. After the Covid 19 eruption, Plexiglas panels were installed to protect against infection.

© Moises Castillo / AP / Keystone

It was to be feared, and it has now become reality. As revealed by the Transnational Institute, Peru, Mexico and Argentina constitute at least three Latin American countries threatened with lawsuits before arbitral tribunals over measures they have introduced to fight the corona crisis. What exactly has taken place? In early April, when growing numbers of Peruvians risked losing their jobs, the Peruvian Parliament adopted a law suspending highway tolls in an attempt to facilitate or promote the movement of goods and people. The reaction of the foreign companies that hold the corresponding highway concessions was not long in coming. As early as June they announced that Peru would be brought before a World Bank arbitral tribunal (ICSID — International Centre for Settlement of Investment Disputes). This scared the Minister for Economic Affairs into launching a process to circumvent the law and maintain the toll charges, despite the potential unconstitutionality of that process. This is known as the chilling effect: fearful of the prospect of having to pay rather hefty compensation to the foreign investor — plus court costs — a government renounces a measure it has taken in the public interest. Peru’s Constitutional Court must now rule on the legality of the executive climb-down, and depending on the decision, the complaining parties will decide whether or not to take their case to the arbitral tribunal.

Mexico and Argentina in the hot seat

Shortly thereafter it was Mexico's turn to irk foreign investors by restricting the production of renewable energies owing to a drop in power consumption. Several law firms specialising in international arbitration immediately encouraged the foreign energy companies concerned to bring a potentially lucrative action against Mexico. Spanish and Canadian companies have already expressly raised this possibility. Lastly, there is the case of Argentina, which is sinking ever deeper into a never-ending crisis. On 22 May the government announced that it was defaulting on its debts to foreign creditors, including BlackRock, the world's largest asset management company. With the blessing of the International Monetary Fund (IMF), negotiations were also taking place on the rescheduling of 66 billion US dollars of sovereign debt. On 4 August, Argentina announced its readiness to pay 54.8 per cent of its debt – BlackRock had demanded 56 per cent and Argentina had initially offered 39 per cent. This capitulation was no chance matter. On 17 June, BlackRock's law firm White and Case had threatened to use all means at its disposal to force Argentina to back down – a thinly veiled reference to international arbitration. It was the same law firm that had successfully sued the Argentine State for 1.35 billion US dollars on behalf of 60,000 Italian bondholders in 2016. In what is known as the Abaclat case, they had rejected the bond exchange offer launched by the government in its endeavour to deal with the 2001 economic crisis.

When multinationals go treaty shopping

Still in Latin America, and more specifically in Bolivia, there are two arbitration proceedings pending between the State and Glencore, the commodity trading company domiciled in Switzerland. In the light of the pandemic, Bolivia had requested the temporary suspension of arbitral proceedings in two mining disputes. Invoking force majeure, La Paz argued that the pandemic was hindering the Bolivian Government from submitting the requisite documentation. Yet it failed. What is noteworthy is that the Glencore lawsuits are not based on the investment protection treaty between Switzerland and Bolivia, as that treaty had been renounced by the Andean country, like other developing and emerging countries (Ecuador, Indonesia, India, South Africa). For the arbitration proceedings, Glencore managed to identify itself as a British company and invoked an investment protection treaty between Great Britain and Bolivia. This approach is by no means unusual and in expert circles is beautifully termed "treaty shopping". This means that a multinational invokes the international treaty that promises to be the most lucrative. Chevron is yet another company that practices treaty shopping. The US energy company that has been embroiled in a legal dispute with Ecuador over negligent environmental pollution for 30 (!) years now, has instituted proceedings against the Philippines over an offshore gas drilling platform. In this latter case, Chevron is able to invoke the Swiss-Philippine investment protection treaty, which obviously offers better prospects of winning the legal battle against the Asian island nation.

The routine threat and frequent filing of actions by multinational corporations against countries have prompted a growing number of States to question the meaning and purpose of investment protection treaties. This trend is being even further stoked by the abysmal failure of many of these agreements to attract anything like the level of investment hoped for by the recipient countries. The topics up for discussion are the abolishment of these agreements, or at least the ruling out of the use of the controversial international arbitration approach in dispute settlement, and turning instead to domestic courts.

Avalanche of lawsuits after Chile's constitutional reform?

The French conglomerate Suez has threatened Chile with legal action should the municipal authority again take charge of the water supply system in the southern Chilean city of Osorno, as is the wish of that city's residents. This dispute was triggered by a 10-day interruption of the water supply last year following an oil pollution incident at the drinking water processing plant operated by the subsidiary of the French multinational. Corona crisis allowing, the Chilean people will be voting on constitutional reform on 25 October. Approval of the reform could unleash a veritable avalanche of lawsuits in Chile, as multinational companies have a strong presence in all spheres of life in that country, especially in the public services.

This and countless earlier cases illustrate just how unequally the possibilities for taking legal action are distributed between States and investors. Only very few investment protection treaties contain provisions allowing States in turn to bring legal action against foreign investors, for example, if they violate human rights or environmental standards. The investment treaty concluded by Switzerland contains no explicit provision for this. Alliance Sud has been sharply critical of this for years now. IA

Share post now