Share post now

Article

Debt brake: cost-cutting with a passion

09.03.2023, Finance and tax policy

During the pandemic, the debt brake was declared a national shrine. In financial policy terms, it was deemed a condition sine qua non for Switzerland's successful handling of the crisis. But is that really so? A ride through austerity hell.

Bundesrätin Karin Keller-Sutter, fotografiert im Bundeshaus, Bern, Schweiz.

© Raffael Waldner/13Photo

Federal finances are in a bad way," said the new Swiss Finance Minister Karin Keller-Sutter a few weeks ago at a press conference, as she presented the federal government's accounts for 2022 and assessed fiscal policy for the years ahead. Last year recorded a deficit of 4.3 billion francs, sizeable deficits are also in prospect for the next few years, and the Federal Council wants to cut costs. But if we plough through the Confederation's finances for the past 20 years and through the rules of the debt brake, what we find is that it is the latter that is mainly in difficulty.

What is the debt brake?

The debt brake was introduced in 2003. Under the Federal Budget Act, its purpose is to preserve a balance between federal receipts and expenditure over an extended period of time and thereby counter a steadily growing federal debt. The Federal Finance Administration (FFA) writes: "At the core of the debt brake is a simple rule: expenditure may not exceed receipts over an economic cycle". An economic cycle is generally construed as an extended period during which an economy goes through several phases: upswing, boom, downturn, recession, upswing. One may well think that the balance of receipts and expenditure must therefore be adjusted throughout such an economic cycle. That, at any rate, is what the above FFA statement seems to imply. It would mean that in surplus years, the Confederation would pay into a piggy bank, and in deficit years, it would draw on those savings. The piggy bank's account balance would thus have to be zero throughout the economic cycle. But the debt brake is simply not a piggy bank. The expenditure rule and the specific provisions on the compensation account prevent this. The cost-cutting devil is in the detail.

The expenditure rule

The expenditure rule requires the federal government to generate budget surpluses in years of strong economic growth, when corporate profits are high, wages and consumption rise, and the State therefore garners more tax revenue. The federal government is permitted to run deficits during downturns. Yet, under the expenditure rule, it is not enough for surpluses (positive sum of receipts minus expenditure) and deficits (negative sum of receipts minus expenditure) to balance each other out over an entire economic cycle. In good years, the expenditure rule mandates that a surplus is generated. This prompts the federal government to make savings even in good years, and drastically limits its financial leeway. If you now think of a squirrel, which does not eat all the acorns it gathers in the summer (boom years), but stores some away for the winter when food is scarce (years of downturn), you have understood the matter so far. The only thing is that the surpluses from good years may not go into the pantry for consumption in bad years, but must serve to reduce debt. This means, in a manner of speaking, that the "federal squirrel" must give the acorns it saves to the "wild boars" (the Confederation's creditors). It therefore diets in good summers, and must still go hungry in harsh winters – even though that may not be at all helpful, as we are about to see.

The compensation account

The compensation account is not really an account. It is the federal government's milk maid calculation (Milchbüchlein), but it is not a wallet. No money can be deposited into it. The Federal Finance Administration sees it as providing “control statistics for the extraordinary budget”. Budget surpluses and deficits are recorded in the compensation account. If a year's accounts show actual expenditure to be below the expenditure anticipated in the budgeting process, the positive difference is "booked" to the compensation account. The milk maid calculation therefore shows the surplus receipts accruing to the Confederation and used to reduce debt. If expenditure is higher than expected, the milk maid calculation accordingly reflects this; if it is lower than expected, this is also noted. If the balance of the amounts noted is negative, that shortfall must be offset over the ensuing years (no exact timeframe is set). What this means is that the federal government must generate surpluses in the years that follow (through additional revenue, or spending cuts), with which the compensation account can be restored to zero. Debt reduction is then also suspended until the compensation account balance is back in positive territory.

However, the compensation account has never been in the red in the 20-year history of the debt brake. Luck has also played a part. Between 2003 and 2019, the Swiss economy experienced only good-to-very-good years, except for a brief recession during the 2008/2009 financial crisis. The year 2019 therefore closed with the compensation account balance showing a positive 27.5 billion francs. But there's the rub – all of that money had already gone towards debt reduction, and the piggy bank remained empty. On the back of the coronavirus pandemic, the compensation account balance had contracted to 21.9 billion by the end of 2022. But this reduction has no implications for the federal budget, as the balance is still very high. In the past 20 years, the Confederation's debt in francs and centimes diminished from its peak of 128 billion in 2005 to 88 billion in 2019. On the back of the coronavirus pandemic, real debt again rose during the past three years, but is now already falling back. Because the economy also showed strong growth, the debt ratio (total debt to GDP) also dropped.

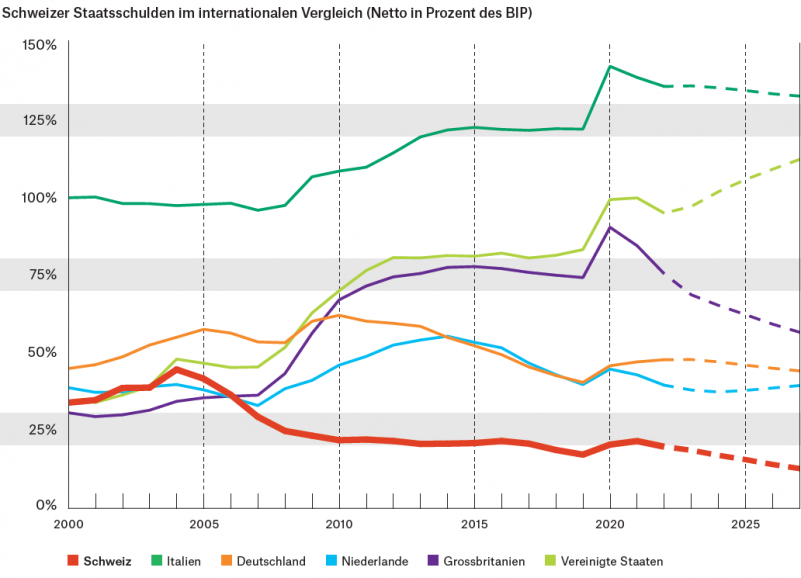

The starting point of the debt level was already very low in 2005. According to the International Monetary Fund (IMF), it dropped from just over 30 per cent to less than 20 per cent (the federal government's figures arrive at an even lower net debt). Today, Switzerland's debt is almost ridiculously low by comparison with its European neighbours and other majors in the financial centre.

A reduction to such a low level, including by international standards, is in fact entirely unnecessary from a financial and economic policy standpoint. The "Eidgenossen", as Swiss government bonds are called, are much too sought-after by local pension funds, investment funds and financial institutions. Investors need not factor in the slightest risk of default. The interest payable by the Confederation on its bonds is accordingly low – and will be for decades.

At the same time, however, the rules governing the debt brake significantly curtailed the federal government's financial leeway in the 2000's and 2010s: the legally prescribed debt reduction prevented the federal government from putting money aside to be spent in leaner times (that would have been a piggy bank). But that is not all – there is also the amortisation account.

Amortisation account

This account regulates the treatment of extraordinary receipts and expenditure by the Confederation. It was brought in a few years after the introduction of the debt brake by means of a legislative amendment. Extraordinary receipts and expenditure are booked to the amortisation account – for example, income from the sale of G5 licences for the mobile phone network, or very substantial extraordinary federal spending in response to the pandemic. If the amortisation account goes into the red, this must be corrected using surpluses from the ordinary budget within six years. Today this is a problem – because of the coronavirus-related costs that were charged to the amortisation account – even though things sounded quite different three years ago. At the onset of the coronavirus crisis in March 2020, the then Finance Minister Ueli Muarer successfully floated the fairy tale of the piggy bank. The date was 20 March 2020, and Switzerland had been in lockdown for a week. At a historic press conference, the Federal Councillor explained how he intended to avert the collapse of the Swiss economy, which was then in virtual paralysis: Maurer himself then asked the first question: "Yes, ladies and gentlemen, dear colleagues – erm, can the Confederation really spend 42,000 million, this 42 billion, this is perhaps the first question that should be asked." The answer was: "I can assure you that the Confederation can, thanks to the fact that our finances are very robust, thanks to the fact that we have reduced debt over recent years, thanks to the fact that we have recorded surpluses, thanks to the debt brake." In short, at the onset of the pandemic, Maurer asserted that the coronavirus bailout measures were being covered by reserves. The Finance Minister therefore personally led the public to believe that the debt brake was a piggy bank. And it worked. There was gushing praise for the debt brake up and down the land, fiscal skinflints and ideological bookkeepers felt vindicated: "Waste not, want not". The fact is that the coronavirus bailouts were made possible only because the Financial Budget Act permits the debt brake to be suspended in exceptional situations. This is covered under the "exception clause".

The exception clause

The Federal Finance Administration writes: "In extraordinary situations (e.g., natural disasters, severe recessions and other uncontrollable developments) it is possible to deviate from the [spending] rules". And this is where we now stand. The coronavirus-related debt must now be eliminated. To this end, further new spending has been approved (in part by Parliament) owing to the war in Ukraine and efforts to combat the associated inflation and the purchasing power crisis. Had the 27.5 billion in fact been put into the piggy bank (or better yet invested and hence substantially increased), it could easily have covered the coronavirus-related deficit of 32.8 billion. The higher debt ratio (which would have diminished automatically during the following years by virtue of expected GDP growth) would have had no fiscal impacts. However, the debt brake regulations do not permit this. There were initiatives along those lines in Parliament, but they never stood a chance. In the end, a parliamentary majority still decided to offset half the costs of the coronavirus bailouts against compensation account surpluses from previous years, and extended the deadline for this reduction to 2035. Such a set-off of extraordinary expenditure against the compensation account balance ought not to be possible under the debt brake rules. In this case, however, Parliament showed little concern about that, and simply wrote a coronavirus-related exception to the exception clause into the Financial Budget Act. The fact is that in this instance, an extraordinary quasi-piggy bank was born, exclusively for coronavirus-related debt.

The upshot is that what largely determines whether the debt brake generates real pressure to cut costs is what the Federal Council and Parliament may or may not choose to include in the milk maid calculation. The question of what could in fact be funded is secondary. In any case, 16 billion in coronavirus debt still remains, and must be reduced by the Confederation by 2035 using surpluses from the ordinary budget. Hence the Federal Council's wish to cut costs, mainly in the areas of education, agriculture and, not least of all, development cooperation. These are all areas on which we will rely heavily if we are to make our society more ecological, caring and secure, and if Switzerland is to contribute appropriately to overcoming the polycrisis in the Global South. Switzerland could indeed be currently addressing problems that are more pressing than keeping its national debt as low as it has done for the past 10 years. Were it to increase by 10 per cent of GDP, or about 50 billion francs, there would not be the slightest harm to the economy, the entirety of the Confederation's current fiscal problems would be solved in one go, and substantial investments could easily be made in a Switzerland that is caring, sustainable and capable of global solidarity. The money could be had, what is now lacking is "merely" the political will to take it.

© Alliance Sud

Eine Reduktion auf ein auch im internationalen Vergleich so niedriges Niveau ist finanz- und wirtschaftspolitisch eigentlich völlig unnötig. Zu begehrt sind die «Eidgenossen», wie Schweizer Staatsanleihen genannt werden, bei hiesigen Pensionskassen, Anlagefonds oder Finanzinstituten. Investor:innen müssen hier nicht die geringsten Kreditausfallrisiken miteinkalkulieren. Entsprechend tief fallen auch die Schuldzinsen aus, die der Bund für seine Anleihen bezahlen muss – und das auf Jahrzehnte hinaus.

Gleichzeitig beschnitten die Regeln der Schuldenbremse den finanziellen Handlungsspielraum des Bundes in den 2000er und 2010er Jahren aber erheblich: Der gesetzlich festgeschriebene Schuldenabbau verhinderte, dass der Bund Geld zur Seite legen konnte, um es dann in schwierigeren Zeiten wieder auszugeben (das wäre das Sparschwein gewesen). Aber damit nicht genug, es gibt nämlich auch noch das Amortisationskonto.

Das Amortisationskonto

Dieses regelt den Umgang mit ausserordentlichen Einnahmen und Ausgaben des Bundes. Es wurde einige Jahre nach Einführung der Schuldenbremse mit einer Gesetzesänderung zusätzlich geschaffen. Auf dem Amortisationskonto werden ausserordentliche Einnahmen und Ausgaben verbucht – so etwa die Einnahmen aus dem Verkauf der G5-Lizenzen für das Mobilfunknetz oder die sehr hohen ausserordentlichen Ausgaben des Bundes zur Bewältigung der Pandemie. Wenn das Amortisationskonto ins Minus fällt, muss dieses mit Überschüssen aus dem ordentlichen Haushalt innerhalb von sechs Jahre wieder behoben werden. Das ist heute – wegen der auf dem Amortisationskonto verbuchten Corona-Kosten – ein Problem, auch wenn das vor drei Jahren noch ganz anders klang. Zu Beginn der Corona-Krise im März 2020 setzte der damalige Finanzminister Ueli Maurer nämlich ein in der Folge das erfolgreiche Märchen vom Sparschwein in die Welt. Man schrieb den 20. März 2020. Seit einer Woche war die Schweiz im Lockdown.

An einer geschichtsträchtigen Medienkonferenz informierte der Bundesrat darüber, wie er die Schweizer Wirtschaft im Beinahe-Stillstand vor dem Kollaps bewahren will: Maurer stellte die erste Frage dann gleich selbst: «Ja, meine Damen und Herren, liebe Kolleginnen und Kollegen – äh, kann der Bund überhaupt 42’000 Millionen ausgeben, diese 42 Milliarden, das ist wohl die erste Frage, die zu stellen ist.» Die Antwort: «Ich kann Ihnen versichern, dass der Bund das kann, dank dem, dass wir einen sehr robusten Finanzhaushalt haben, dank dem, dass wir die Schulden in den letzten Jahren abgebaut haben, dank dem wir Überschüsse erzielt haben, dank der Schuldenbremse.» Kurz: Maurer behauptete zu Beginn der Pandemie, dass die Corona-Hilfsmassnahmen durch Rücklagen gedeckt seien. Der Finanzminister höchstpersönlich liess die Öffentlichkeit also im Glauben, dass die Schuldenbremse ein Sparschwein sei. Und es funktionierte: Landauf, landab setzte eine Lobhudelei auf die Schuldenbremse ein, finanzpolitische Geizkragen und ideologische Buchhaltermenschen sahen sich bestätigt: «Spare über die Zeit, so hast Du in der Not.» Tatsächlich wurden die Corona-Hilfsgelder nur möglich, weil das Finanzhaushaltsgesetz in Ausnahmesituationen die Aussetzung der Schuldenbremse erlaubt. Das ist in der «Ausnahmebestimmung» geregelt.

Die Ausnahmebestimmung

Die Eidgenössische Finanzverwaltung schreibt: «In aussergewöhnlichen Situationen (so etwa bei Naturkatastrophen, schweren Rezessionen und anderen nicht steuerbaren Entwicklungen) ist es möglich, von der [Ausgaben-]Regel abzuweichen. Und hier stehen wir jetzt. Die Corona-Schulden müssen wieder abgebaut werden. Dazu wurden (z. T. vom Parlament) wegen des Kriegs in der Ukraine und der Bekämpfung der damit verbundenen Inflation und der Kaufkraftkrise noch neue zusätzliche Ausgaben beschlossen. Wären die 27,5 Milliarden tatsächlich ins Sparschwein gelegt worden (oder besser noch investiert worden und damit stark gewachsen), hätte man das Corona-Minus von 32,8 Milliarden ganz einfach damit decken können. Die höhere Schuldenquote (die sich in den nächsten Jahren aufgrund des zu erwartenden BIP-Wachstums von selbst wieder reduziert hätte) hätte keine finanzpolitischen Folgen. Doch das lassen die Regeln der Schuldenbremse nicht zu. Im Parlament gab es Vorstösse in diese Richtung, doch sie blieben chancenlos. Am Ende entschied eine Mehrheit des Parlamentes immerhin, die Hälfte der Kosten für die Corona-Hilfen mit den notierten Überschüssen auf dem Ausgleichskonto aus den vergangenen Jahren zu verrechnen und verlängerte die Frist dieses Abbaus bis 2035. Eine solche Verrechnung ausserordentlicher Ausgaben mit dem Saldo des Ausgleichskontos dürfte es eigentlich gemäss Schuldenbremsen-Regeln gar nicht geben. Das kümmerte das Parlament aber in diesem Fall wenig und so hat es hier kurzerhand einfach eine coronabedingte Ausnahme von der Ausnahmeregel ins Finanzhaushaltsgesetz geschrieben. Es hat in diesem Fall also tatsächlich ein ausserordentliches Teil-Sparschwein exklusiv für Corona-Schulden geboren.

Es zeigt sich: Ob die Schuldenbremse einen realen Spardruck auslöst, hängt wesentlich davon ab, was Bundesrat und Parlament in ihrem Milchbüchlein der Schuldenbremse notieren wollen und was nicht. Die Frage, was tatsächlich finanzierbar wäre, ist nebensächlich. Von den Corona-Schulden bleiben jedenfalls immer noch 16 Milliarden, die der Bund bis 2035 mit Überschüssen aus dem ordentlichen Haushalt abbauen muss. Deshalb will der Bundesrat nun also sparen: vor allem in der Bildung, der Landwirtschaft und nicht zuletzt in der Entwicklungszusammenarbeit. Alles Bereiche, auf die wir dringend angewiesen wären, um unsere Gesellschaft ökologischer, sozialer und sicherer zu machen und einen angemessenen Beitrag der Schweiz zur Bewältigung der Vielfachkrise im Globalen Süden sicherzustellen. Es gäbe heute auch für die Schweiz in der Tat dringendere Probleme, als ihre Staatsverschuldung so tief zu halten, wie sie in den letzten zehn Jahren war. Würde sie um zehn Prozent des BIP oder ca. 50 Milliarden Franken ansteigen, ergäbe das nicht den geringsten volkswirtschaftlichen Schaden, sämtliche gegenwärtigen finanzpolitischen Probleme des Bundes wären auf einen Schlag gelöst und grosse öffentliche Investitionen in eine soziale, nachhaltige und globalsolidarische Schweiz problemlos möglich. Das Geld wäre da, jetzt fehlt «nur» noch der politische Wille, es auch zu nehmen.